Japan Carry Trade Unwinds And Kamikazes The Stock Market

3 Min Read | 800 Words

This week, we delve into the tumultuous world of the yen carry trade unwind, a striking example of how global financial dynamics and central bank policies can create ripple effects across markets. Japan’s central bank recently averted a potential financial disaster, emphasizing the critical role of risk management and investor objectivity. This event offers valuable lessons in international finance, the importance of maintaining a long-term investment perspective, and the need to separate emotions from investment decisions.

Fun Fact

Did you know that the Tokyo Stock Exchange has a mascot named "Kabuto-kun," a samurai warrior helmet? It's a quirky symbol meant to bring good fortune and protect traders from market volatility! 📉🛡️

Global Markets Dive As Japan Carry Trade Unwinds

In the fast-paced world of global finance, stock markets, forex markets, hedge funds and all that buzz, few events have caused as much turmoil recently as the unwinding of the yen carry trade. Japan’s central bank narrowly avoided a financial disaster, preventing what could have been a self-inflicted economic crisis. For accounting and finance students, this event is a crucial case study in risk management, international finance, the dangers of markets and monetary policy.

What Happened?

In the days leading up to last Tuesday’s market open, global stock markets saw a loss of at least a quarter trillion dollars. U.S. stocks led the selloff, but Japan's Nikkei 225 index took an even harder hit, losing more than 12% on Monday alone – its worst day since 1987.

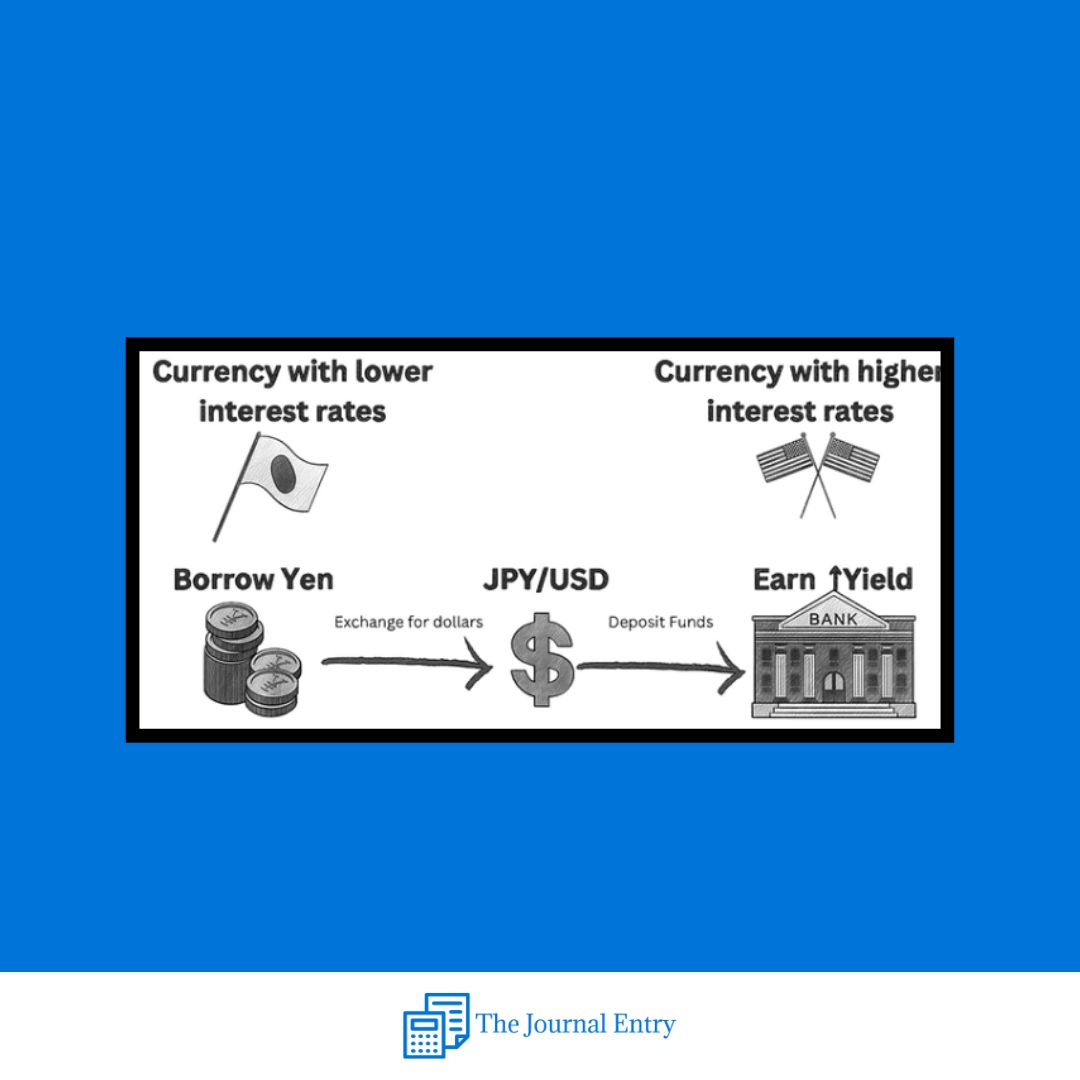

But what caused all the fuss? The unwinding of the yen carry trade. This strategy, one of the largest currency trades in the world, involves borrowing yen at low interest rates, due to Japan’s famously low rates, to invest in higher-yielding assets elsewhere. This makes it one of Wall Street’s top hedge funds and investment banks favourites.

The Bank of Japan’s (BoJ) recent actions and global economic conditions led to a rapid unraveling of this trade, which up to this point had amassed a notional value of at least $20 trillion according to Deutsche Bank

Why Did It Happen?

As always a domino effect of unfortunate events and poor timing compounded:

The U.S. Federal Reserve's decision to hold rates steady, combined with weak labor market reports, spiked U.S. macro concerns.

Earnings data in the U.S. validated some of these macro concerns.

The BoJ considered raising rates to combat inflation but decided against it, avoiding a potential market meltdown.

These factors caused bond yields to fall in the U.S. and rise in Japan, leading to an unexpected but significant appreciation of the yen against the USD. This sudden spike disrupted the carry trade, which relies on stable exchange rates for profitability. As the yen strengthened, investors were forced to cover their positions, triggering a global margin call and widespread asset selloffs

Where do we fit into this?

For accounting and finance students, the yen carry trade unwind offers several valuable lessons:

Global Interconnectedness: Changes in one country’s monetary policy can have far-reaching effects. Understanding these dynamics is crucial for international finance. This becomes ever more apparent for those individuals aiming for top positions in international companies as well as market related players.

Market Strategies: Leveraged trading strategies like the yen carry trade can be highly profitable but come with significant risks. Effective risk management is essential to mitigate potential losses. It’s also essential that we explore the realm of data science and algorithms in automation trading, while still focusing on their inherent lack of ability to predict market events such as the yen carry trade unwinding.

Investor Objectivity: One of the most crucial skills for finance professionals is maintaining objectivity, especially during market turmoil. The yen carry trade unwind underscores the importance of separating emotions from investment decisions and highlights the need to make calm, conscious choices under adverse circumstances. It also emphasizes the value of a long-term investment perspective, as evidenced by the S&P 500 ending in positive territory and still showing an annual return of 12% despite the unwinding and market bomb dropped.

Round Up

The recent unwinding of the yen carry trade highlights the importance of maintaining investor objectivity and separating emotions from investment decisions. This event illustrates the value of essential skills which finance professionals need to cultivate in order to brave the market.

Resources

We’ve compiled a list of our favourite value-packed finance and other resources, including industry relevant courses from Wall Street Oasis.

Check them out!

Make Your Mark On “The Journal Entry”

Fill out the form below with any content topics you’d like to see us cover.

If you enjoy our content we’d love it if you showed your friends and peers!

Or copy and paste this link to others: