From Cape Town to Costco: The Rise of Pura Beverage

2 Min Read | 550 Words

If you ever doubted that a “small local drinks brand” could make waves globally, meet Pura Beverage. The Cape Town-founded company has quietly secured a R260 million investment to fuel its expansion, specifically into the United States.

It didn’t just “export one container and hope for the best.” Pura staged a strategic leap. Let’s unpack what they’re doing, what it means for SA businesses, and what lessons lie for those studying to be CA(SA)s.

🧠 Fun Fact:

Honey never spoils. Archaeologists have found pots of honey in ancient Egyptian tombs that are over 3,000 years old and still perfectly edible.

The Business & Market Play

Pura’s core proposition is simple: real ingredients, low sugar, no preservatives.

In the U.S., that message is resonating. Recently, U.S. sales of beverages made with 100 % natural cane sugar spiked by over 50 %, pushing the segment past US$600 million in revenue.

Consumers as they become more and more health conscious are tiring of artificial sweeteners and “zero sugar” gimmicks. Pura is surfacing just at the inflection point of that health trend.

Instant Impact in U.S. Retail

Launch day sales crossed US$1 million. That kind of splash gets attention. Even more importantly, major U.S. retailers (Walmart, Target, Whole Foods, Costco) have expressed interest.

This gives Pura both reach and signals that it’s playing in the big leagues.

Funding to Scale Smarter, Not Just Bigger

The R260m acts as its vote of confidence. However, from a financial perspective Pura plans to deploy it across:

Attracting top global talent

Strengthening distribution networks

Expanding the product suite

Upping marketing muscle

Focusing on sustainable growth, brand building, and infrastructure.

Strategic Reflection - From the Accounting Lens

As someone steeped in SAICA’s framework (and with one eye always on commercial realism), here are some angles worth pondering:

Currency & Financial Risk

Launching in the U.S. exposes Pura to exchange rate volatility (ZAR vs USD swings). As we know that functional currency choice, translation adjustments, and foreign currency risk provisioning will be crucial.

Cost of Entry & Margins

Distribution, logistics, import duties, cold chain, shelf space fees all of which will erode margins. Similar to “overheads” in a big audit client, you need a model that anticipates all the hidden costs. If margins collapse, growth becomes a treadmill.

Compliance & Labeling

Different markets = different regulations. U.S. FDA rules, nutritional labeling, sugar claims, “natural” labels: all of these come under heavy scrutiny. A compliance slip could undo brand trust.

Brand vs Volume Trade-off

Do you go mass-market or premium niche? The U.S. shelves are crowded. Pura’s health positioning gives license for premium pricing, but scale often demands volume play. The balancing act will require close financial modeling, scenario planning, and sensitivity analyses.

Bottom Line

Pura Beverage is more than an export success story. It’s a strategic experiment in scaling South African innovation to global markets. Though the path is fraught, the upside is compelling: building a brand with roots in SA that competes globally.

If you were Pura’s CFO, here’s a challenge for you:

How would you structure the capital allocation and risk buffers to ensure the U.S. expansion doesn’t end up sinking the core operations back home?

Send in your answer and if it’s sharp, I’ll spotlight it in next week’s edition with attribution (or anonymity, if you prefer 😉).

Our Recommended Investment Platforms

VALR - Crypto

As crypto continues to gain mainstream industry adoption, it has never been a better time to start investing in the revolutionary technology behind crypto. So, If you're into crypto or interested in getting started, you need a platform that offers simplicity, low fees, top security, and awesome rewards—and that’s exactly what VALR delivers.

Sign up today through our referral link to kickstart your journey.

Why trade on VALR?

✅ Super-low trading fees

✅ Instant deposits & withdrawals

✅ A massive selection of crypto assets

✅ Staking & passive income opportunities

EasyEquities - Stocks, ETFs and More

We believe that starting early and consistency is key to building wealth. If you’re looking to take control of your finances, now is the perfect time to invest any disposable income you have. By making small, consistent investments, you can unlock long-term financial growth.

With EasyEquities, investing in stocks, ETFs, and more has never been simpler or more accessible. Whether you're a beginner or a seasoned investor, you can start building your portfolio with as little as R50.

Sign up through the link below and receive R50 free to kickstart your investment journey. It’s an easy, affordable way to make your money work for you.

Start today—your future self will thank you! 🚀

Sign Up for Trainee Contract Opportunities

For those of you working toward your CA(SA) qualification, we’ve got great news! As a subscriber to The Journal Entry, we’re doing our best to find article program opportunities for you.

Don’t miss the chance to grow your professional network and take that crucial step toward your CA(SA) designation.

Be sure to fill out the sign-up form linked below to stay informed about upcoming trainee positions!

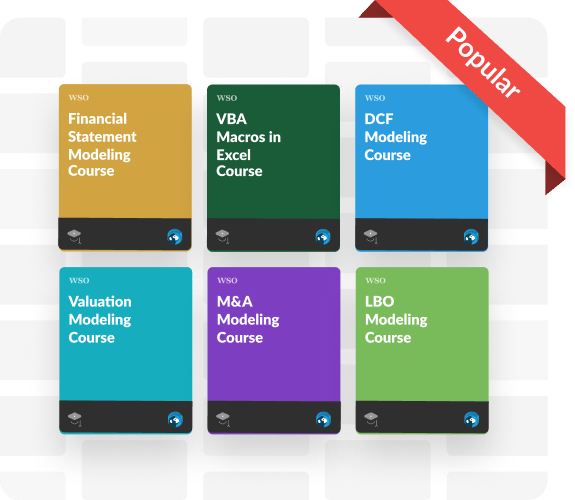

High Finance Courses

We've rounded up the most valuable high-finance courses from Wall Street Oasis to help give you a competitive edge.

As a valued member of The Journal Entry community, you get 20% off—just use the link below.

Take a look and level up your finance game!

Make Your Mark On “The Journal Entry”

Fill out the form below with any content topics you’d like to see us cover.

If you enjoy our content we’d love it if you showed your friends and peers!

Please copy and paste this link to others: