Brace Yourselves!

5 Min 50 sec Read

This week we take a quick dive into some major topics in the SAICA accounting program, namely IAS 16: Property Plant and Equipment, Income Tax, Absorption costing, process costing and assurance engagements.

We also discuss the impact of the 2024 Budget Speech for South Africa, presented by minister of finance Enoch Godongwana on the 21st of February 2024.

Financial Accounting

IAS 16: Property, Plant And Equipment

This weeks financial accounting topic is IAS 16: Property, Plant and Equipment. Lets take a look below at some key points for this accounting standard.

The Key definition:

Property, plant and equipment are tangible items that:

(a) are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and

(b) are expected to be used during more than one period.

The purpose of such a broad definition is to cater for the various industries of business. However common examples across industries are office buildings(used for administrative purposes). Another easy to understand example regarding the “production or supply of goods or services” is any sort of machine used in a production process, which is therefore used to create products the entity can sell.

The next section aims to provide a quick overview of how an item that meets the above definition is subsequently treated.

Principle | Breakdown of Principle | |

|---|---|---|

Recognition | The cost of an item of property, plant and equipment shall be recognised as an asset if, and only if: (a) it is probable that future economic benefits associated with the item will flow to the entity; and (b) the cost of the item can be measured reliably. | When referring to this paragraph of the standard, it is important to consider the terms used with a predisposed understanding of “The Conceptual Framework” and its asset definition. For the purpose of this summary it is linked but will be discussed in future editions. |

Measurement At Recognition | An item of property, plant and equipment that qualifies for recognition as an asset shall be measured at its cost. | Cost: -Purchase price -import duties -non-refundable purchase taxes -(Deduct all trade discounts and rebates) -other costs needed to bring the asset to the location and condition needed for management’s intended use. Other costs -costs of site preparation(e.g. sustainability testing/permits) -initial delivery/handling -installation/assembly -costs of testing asset functionality(e.g. demo runs of machinery) -professional fees(e.g. lawyers fees) |

Measurement After Cost | An entity shall choose either the cost model or the revaluation model as its accounting policy and shall apply that policy to an entire class of property, plant and equipment. | Cost Model Value of the asset = Cost - Accumulated Depreciation - Impairment Losses Revaluation Model Value of the asset = Fair Value - Accumulated Depreciation - Impairment Losses *Fair Value: Price of an asset if it were to be traded between two ordinary market participants |

Management Accounting And Decision Making

Absorption Vs. Variable Costing

Absorption | Variable |

|---|---|

Allocates all manufacturing costs, including fixed overheads. | Allocates Only variable manufacturing costs. |

Makes use of a predetermined overhead rate to allocate overheads: Budgeted Overheads/Budgeted Production | Considers overheads as a period cost. |

Used for reporting purposes. Also used by tax officials to determine the profit amount used when calculating income tax. | Used for decision making and internal management purposes. |

Process Costing

Process costing can be broken down into an unbeatable 7 step framework:

Illustrate the process on a timeline

Reconcile the Inputs/Outputs using a table

Inputs | Unit Of Measurement | Outputs | Unit Of Measurement |

|---|---|---|---|

Opening work in progress | x | Finished Goods: From new inputs | x |

New inputs | x | Finished Goods: From opening work in progress | x |

- | Normal loss | x | |

- | Abnormal loss | x | |

Total | x | Total | x |

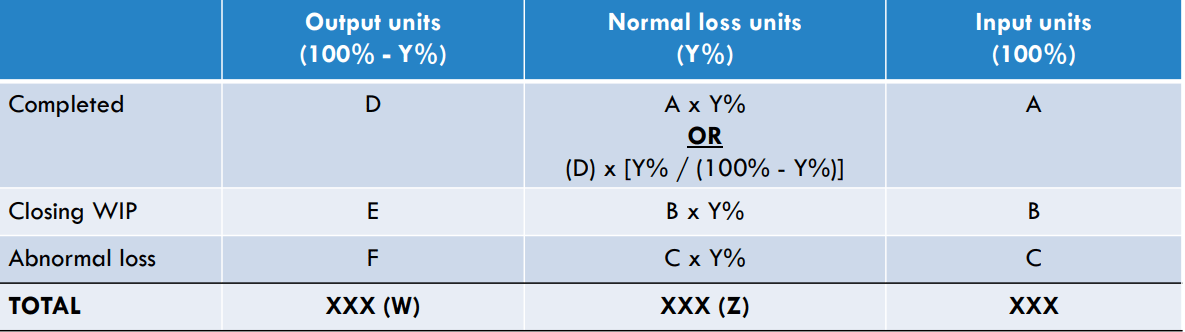

Allocate normal loss

Determine the equivalent units

amnt. = amnt. of units that used the component/input

Material 1 | Material 2 | Overheads | etc. | |

|---|---|---|---|---|

Finished goods: from new inputs | amnt. | amnt. | amnt. | amnt. |

Finished goods: from opening work in progress | amnt. | amnt. | amnt. | amnt. |

Closing work in progress | amnt. | amnt. | amnt. | amnt. |

Normal loss | amnt. | amnt. | amnt. | amnt. |

Abnormal loss | amnt. | amnt. | amnt. | amnt. |

Calculate total costs

Material 1 | Material 2 | |

|---|---|---|

Cost | x | x |

Calculate cost per equivalent unit

Material 1 | Material 2 | |

|---|---|---|

Cost | x | x |

Equivalent units | y | y |

Cost per equivalent unit | x/y | x/y |

Allocate the costs

Material 1 | Material 2 | |

|---|---|---|

Cost per equivalent unit | a | a |

Finished Goods: from new inputs | a * equivalent units | a* equivalent units |

Finished Goods: from opening work in progress | a * equivalent units | a * equivalent units |

Closing work in progress | a * equivalent units | a * equivalent units |

Normal loss | a * equivalent units | a * equivalent units |

Abnormal loss | a * equivalent units | a * equivalent units |

Tax

Income Tax: Residency

This week we take a quick overlook at income tax, and more specifically how to determine if someone is a resident and therefore taxable as per South African legislation.

A person may either be tested for residency based on the ordinary resident test or the physicals presence test:

Ordinary Resident | Physical Presence |

|---|---|

Degree of continuity | > 91 days in the current year |

Mode of life of the taxpayer(the way you live, spend money, and own things) | > 91 days in five prior years |

Physical presence(Must actually be in the country) | > 915 days in total in five prior years |

Intention of being in the country | Ceases to be a physically present resident after 330 days continuously out of the country |

Other relevant facts |

Current Affairs

South African Budget Speech 2024

Key Highlights

1. Income Tax Updates:

Income tax rates and tax brackets remain unchanged.

Medical tax credits also remain the same.

Personal income tax adjustments will align with income inflation.

2. Solar Panel Rebate:

The solar panel rebate is not being renewed and will end on February 29, 2024.

3. Excise Duty Changes:

Excise duty on alcoholic beverages will increase by a maximum of 7.20%.

Excise duty on tobacco products will increase by a maximum of 8.20%.

Notably, electronic cigarette items (vapes) will face an increase to R3.04 per millilitre.

4. Retirement System Implementation:

The implementation date for the retirement two-pot system is confirmed for September 1, 2024.

This system allows individuals to access a portion of their retirement savings before retirement.

5. Global Minimum Corporate Tax:

A global minimum corporate tax has been proposed, set to be implemented from the fiscal year 2026/2027.

Impact On The Accounting World

1. Income Tax Stability:

Accountants will need to ensure compliance with existing income tax rates and brackets. Although there are no changes, they must stay updated to accurately advise clients on tax planning strategies. The decision to leave income tax unchanged may also allow for greater consumer spending for the fiscal year, overall helping the business environment however in the challenging circumstances this may not have a noticeable impact.

2. Solar Panel Rebate Conclusion:

Renewable energy businesses might experience changes in demand when the solar panel rebate ends. Accountants who advise these businesses need to think about how this could affect their financial plans and investment choices. This will impact both the decisions of businesses looking at renewable energy project as well as those in the business of supplying backup power systems.

3. Excise Duty Increases:

Accountants helping clients in the alcohol and tobacco industries need to consider how increases in excise duty will affect pricing and profits as well as considering the consumers perception and burden of these increased taxes.

4. Retirement System Changes:

Accountants will be important in helping businesses and individuals with the new retirement two-pot system. They will update financial plans and give advice on accessing retirement savings early. It will also pay dividends for accountants to have a clear understanding of the transaction process this will follow when business are required to contribute to retirement savings.

5. Global Minimum Corporate Tax Proposal:

Accountants in multinational corporations should get ready for a global minimum corporate tax. They may need to change their tax plans and evaluate how it will affect their international activities.

If you enjoy our content we’d love it if you showed your friends and peers!

Or copy and paste this link to others: