Short And Sweet

5 Min Read

This week we take a look at an exciting new prospect for accountants in crypto as well as some imperative financial accounting and tax topics with changes in estimates and policies and gross income respectively.

We're also streamlining our newsletter for brevity and would greatly appreciate your feedback on what you expect from us. Please take a moment to fill out a brief survey at the end to share your preferences regarding the newsletter's length. We value your opinion and look forward to hearing from you.

Table of Contents

Financial Accounting

IAS 16: Property, Plant And Equipment

Changes In Residual Values, Depreciation Methods and Useful Lives

While accounting is frequently perceived as a strictly objective discipline, it often navigates through gray areas. For instance, a business might initially account for a piece of Property, Plant, and Equipment (PPE) using specific residual value, depreciation method, and useful life assumptions, only to later discover a more appropriate accounting approach.

To address such situations, accountants must discern whether the change pertains to an estimate or a policy, this is elaborated upon in IAS 8. However, for the context of PPE, this concept can be succinctly summarised.

Estimate Vs. Policy

Estimate:

An accounting estimate involves the judgment and approximation necessary when preparing financial statements, particularly when there is uncertainty or incomplete information. Estimates are used to account for items that are not precisely measurable or for situations where future outcomes are unknown. Accountants make estimates based on their professional judgment, historical data, and the best information available at the time of estimation.

Policy:

An accounting policy is a set of principles, rules, and procedures adopted by a company to govern how it prepares and presents its financial statements. Accounting policies provide guidance on how certain transactions and events are recognized, measured, and disclosed in the financial statements. Policy is effectively the adoption of a reporting framework.

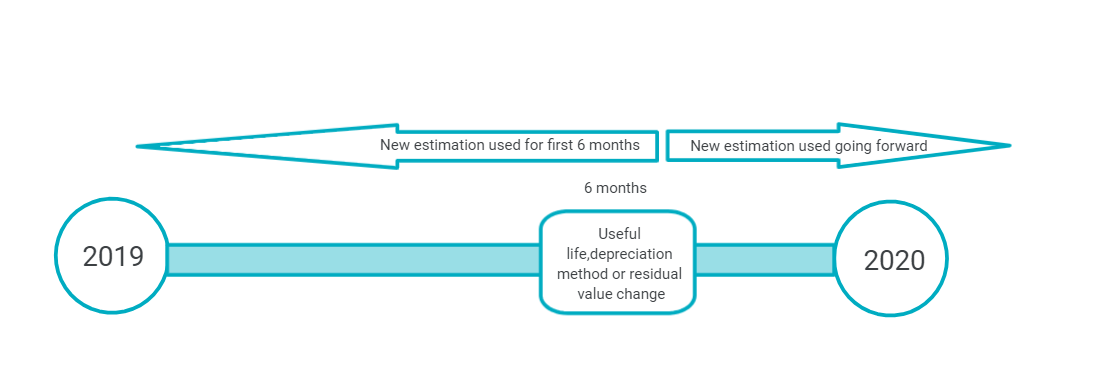

Change In Estimate

When a change in estimate comes into play, the change must be applied prospectively. That means applying the change in the current reporting period and future periods, with no need to adjust the treatment in prior periods.

Change in Policy

With Regards to a change in policy, the change must be applied retrospectively. This involves changing all transactions in accordance with the change, prior, current and future. his means that the change is implemented by adjusting the opening balances of the affected assets in the current period and disclosing the nature and reason for the change in the financial statements.

Tax

Gross Income

Once a person has been deemed a resident of South Africa they are taxed on their gross income, so let’s take a look at what constitutes gross income as per the South African Income Tax Act.

Non-resident are only taxed on their source within South Africa, please note this will be discussed in later editions.

Definition:

The total amount, in cash or otherwise, received by or accrued to a resident during a year of assessment which is not of a capital nature.

Total Amount, In Cash Or Otherwise

*Case laws are included after ‘-’ *

A transaction must have an ascertainable money value - CIR v Butcher Bros

Corporeal or incorporeal(not only cash) - CIR v Lategan

Onus is on the commissioner - CIR v Butcher Bros

Every form of property and rights - CIR v People’s Stores

Non-monetary income must be of a nature where a value can be attached to it in money - CIR v People’s Stores

Non-capital rights capable of being valued in money are included in gross income - CSARS v Brummeria Renaissance

Received By Or Accrued To

Transaction is on taxpayer’s own behalf and for taxpayer’s own benefit - CIR v Geldenhuys

Once the amount is received the taxpayer is taxed - CIR v Wits Association Of Racing Clubs

Deposits are included in gross income unless held in a seperate account- CIR v Pyott Ltd

“Accrued to”:

Become entitled to - CIR v Lategan

Become entitled to unconditionally - SIR v Mooi

Does not need to be due and payable - CIR v People’s Stores

Legality does not affect taxability - C:SARS vs. MP Finance Group / CIR v Delagoa Bay Cigarette

Current Affairs

Bitcoin’s Boom And Cryptocurrency’s Impact On The Accounting World

As Bitcoin continues to soar above R1 000 000, and drags the entire crypto market up with it, it’s important for accountants and students studying toward their accounting profession to realise that Bitcoin and crypto is here, and it’s here to stay. As more and more companies become convinced to get there fair share of the profit pie, what’s even more important is that they accurately disclose these profits and crypto functionalities in their business in accordance with relevant accounting standards.

The current considerations at the forefront of the accounting world are:

Valuation and Recognition: Cryptocurrencies are often volatile, leading to challenges in determining their fair value for financial reporting purposes. Accountants must establish appropriate accounting policies for recognizing and valuing cryptocurrencies on financial statements.

Asset Classification: Determining whether cryptocurrencies should be classified as cash equivalents, financial assets, or intangible assets requires careful consideration due to their unique characteristics.

Internal Controls: Given the decentralized and often anonymous nature of cryptocurrency transactions, maintaining robust internal controls to prevent fraud, errors, and misstatements becomes crucial.

Regulatory Compliance: Accountants need to stay abreast of evolving regulatory requirements related to cryptocurrencies, including taxation, anti-money laundering (AML) laws, and financial reporting standards.

Auditing Challenges: Auditors face difficulties in verifying the existence, ownership, and valuation of cryptocurrencies due to their digital nature and lack of a centralized authority.

Disclosure Requirements: Companies may need to disclose significant holdings or transactions involving cryptocurrencies in their financial statements to provide transparency to investors and stakeholders.

If crypto is something that peaks your interest and you’re looking at investing or already are invested in it, it makes a fun exercise to think about how you could play a part in pioneering what could possibly the next ‘biggest’ accounting standard.

Investing As An Accountant

I believe that investing is a highly beneficial skill for accountants, particularly as a student. It nurtures the ability to analyse advantageous and profitable investment opportunities, setting you apart in the business world and allowing you to excel beyond your peers.

If you're considering cryptocurrency investments, we've partnered with reputable crypto exchanges we trust. This partnership allows us to swiftly get you involved in the market while offering rewards and discounts to enhance your experience.

We Want To Hear You

Let us know if you preferred the more concise format of the newsletter. If you didn't, kindly share your preferred length by completing this quick survey. Your feedback is invaluable to us.

If you enjoy our content we’d love it if you showed your friends and peers!

Or copy and paste this link to others: